Government health care does not cover ambulance costs once any provincial border is crossed. Infographic by Charlie Silver.

People going into debt over medical bills is something that we see all the time in movies and other media, but it’s not something most people think of happening in Canada. Why? Because we have universal health care.

But what happens when we need something not covered by provincial or territorial health insurance?

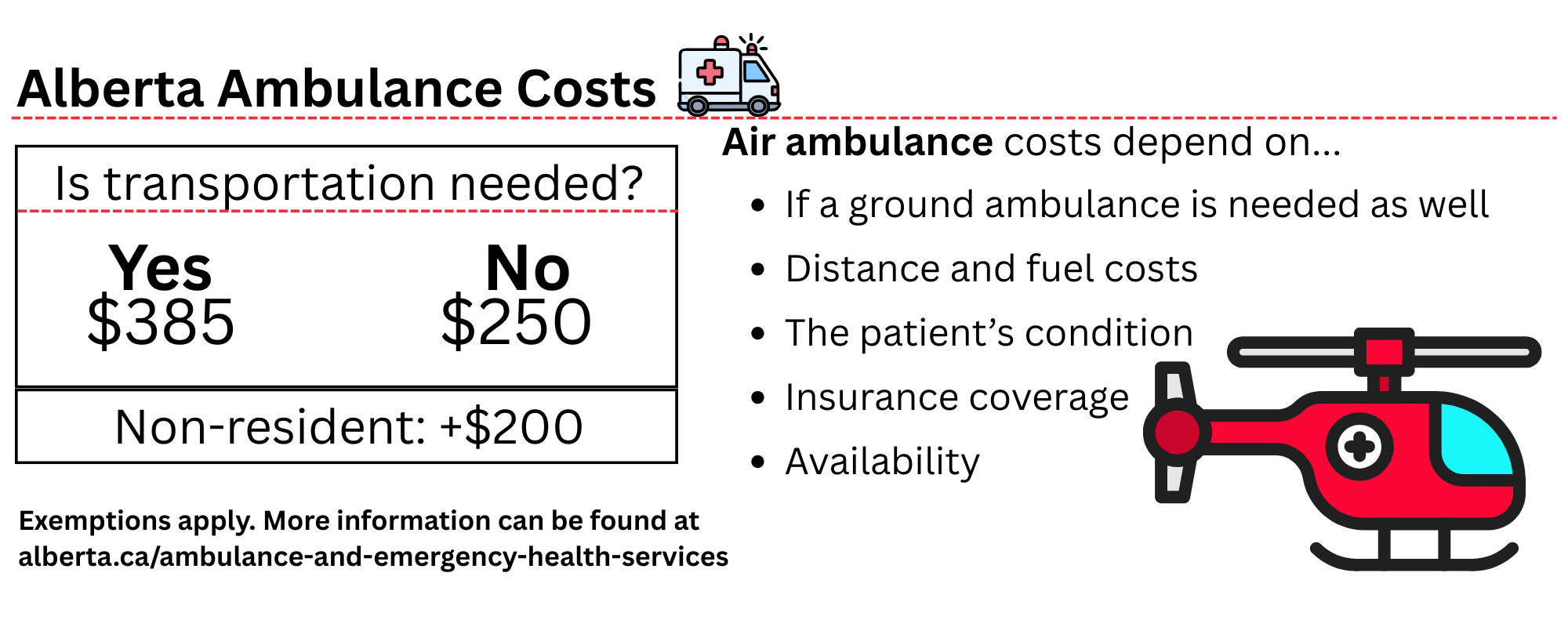

Alberta health insurance covers part of the cost for ambulance calls, but residents are still charged $250 if assisted by an ambulance.

If they need to be taken to the hospital, it becomes $385 regardless of the distance.

An Alberta woman visiting Prince Edward Island in 2011 was charged $600 for a 200-meter ambulance ride after she collapsed at a pharmacy around the corner.

All provinces and territories in Canada charge an extra fee for ambulance calls if the patient is not a resident of that province. In Alberta, it’s an extra $200.

Local retail worker, Maya Wilson, has private insurance through Alberta Blue Cross and says she isn’t sure if her plan covers ambulance costs.

“The wording is so confusing. It says that it will cover the cost of an ambulance if I need to be transported to or from ‘the nearest approved facility able to provide appropriate medical care’ if [Blue Cross] decides it’s medically necessary,” said Wilson.

“What if I don’t need to be transported, or I confuse a panic attack for a heart attack and Blue Cross decides it isn’t a good enough emergency? What if someone else calls one for me and I don’t end up needing it? Do I still get billed?”

Wilson works two jobs, but doesn’t meet the minimum hours per pay period to qualify for benefits at either job and pays over $140 each month for private insurance.

She says it feels like a large price tag for a plan that doesn’t cover nearly enough.

“It only covers so much for each 12-month period, so I still end up paying out of pocket for most things. You’re supposed to go to the dentist twice a year, but my insurance might cover one trip depending on what I need,” Wilson explained.

As an adult with ADHD and anxiety, Wilson says she pays nearly $200 for three months’ worth of her medications after insurance deductions.

Maya Wilson is just one of many Canadians who fears going into dept over medical bills despite having provincial and private health insurance.

She says if the cost of living keeps rising, she worries she won’t be able to afford her insurance, let alone her medications.

Some insurance plans, however, can be quite helpful. Another local retail worker, Theresa Vanness, says the insurance coverage she gets through her work has been life-changing.

“I have chronic muscle pain and was working these labour-intensive jobs, but I could never afford to go to a massage therapist. Then, I got this new job with full time hours and actual benefits that cover things like getting massages and getting my glasses prescription updated,” she said.

Vanness says she believes private health care can be extremely helpful, but it shouldn’t be necessary.

“I don’t think basic human necessities should be so expensive. People shouldn’t be afraid to call an ambulance when they’re bleeding out or something, or having to decide between life-saving medications and food. It’s just not right,” she stated.

Despite there being so many options for private health insurance providers on top of having public health care, Canadians are still spending millions of dollars a year on health-related expenses giving a different meaning to the term “cost of living.”